Mortgage Blog

Helping You Get the Right Mortgage

6 Persistent Real Estate Myths You Really Need to Ignore

September 23, 2025 | Posted by: Jatinderbir Singh Bajwa

Whether you're a home-buyer or a seller, it pays to understand the real estate market if you want to get a good deal. Unfortunately, a series of damaging ideas has grown up around real estate which ca ...

read moreTips to get approved for a mortgage

September 23, 2025 | Posted by: Jatinderbir Singh Bajwa

Key Notes :- Check your credit score as far in advance of applying for a mortgage as possible, and take steps to improve it if necessary. Shop around for the best mortgage rate, which will help ...

read moreSeptember 17-2025 - Bank of Canada lowers policy rate to 2.5%

September 17, 2025 | Posted by: Jatinderbir Singh Bajwa

The Bank of Canada today reduced its target for the overnight rate by 25 basis points to 2.5%, with the Bank Rate at 2.75% and the deposit rate at 2.45%. After remaining resilient to sharply higher ...

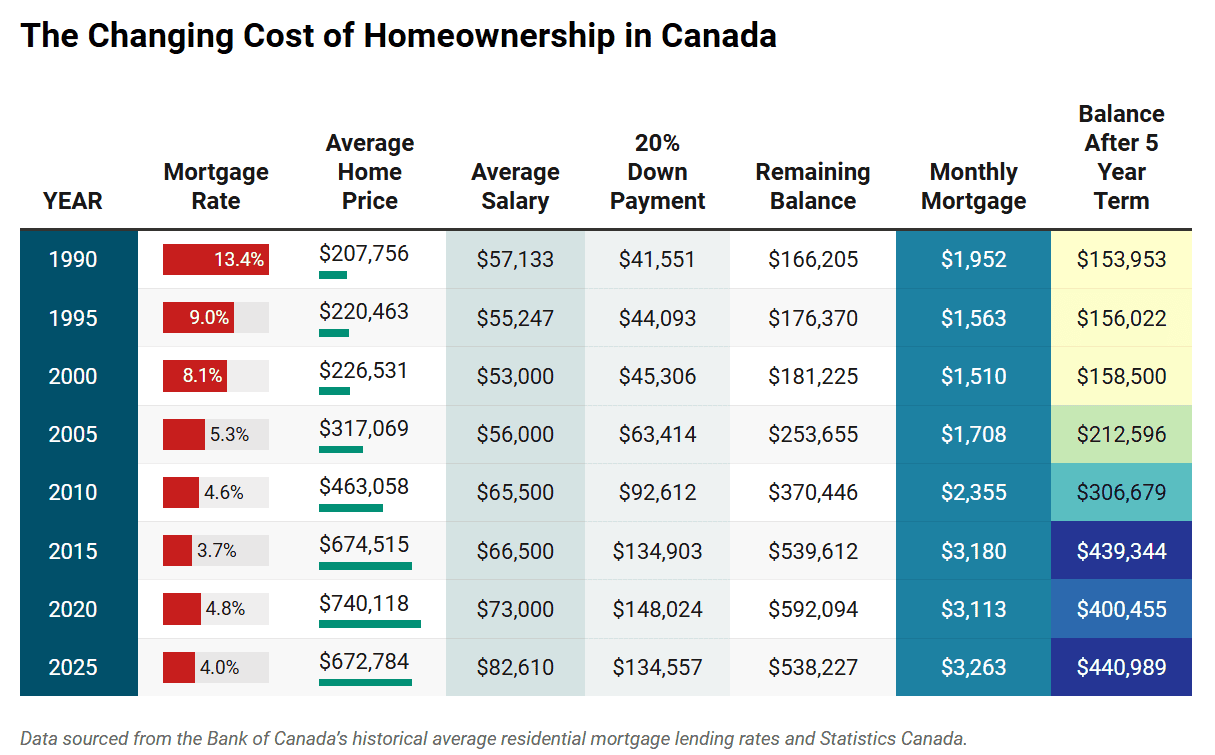

read moreHow mortgages today compare to 35 years ago in Canada

September 9, 2025 | Posted by: Jatinderbir Singh Bajwa

A new analysis has revealed how mortgages in Canada today compare to 35 years ago and the results are bleak for younger Canadians. “For couples in their 30s — the median age when most Can ...

read moreCMHC - Monthly Housing Starts - July 2025

September 3, 2025 | Posted by: Jatinderbir Singh Bajwa

Canadian Monthly Housing Starts and Other Construction Data Tables - July 2025 At our mortgage brokerage, we make it a priority to follow the Canada Mortgage and Housing Corporation's (CMHC) monthl ...

read moreHow long does a consumer proposal stay on your credit report?

August 26, 2025 | Posted by: Jatinderbir Singh Bajwa

ost consumer proposals are structured to be five years in duration. Typically with a fixed payment amount over sixty months. Equifax and TransUnion handle consumer proposals a bit differently, bu ...

read moreWith Inflation at 1.7%, What This Means for Canadians Considering a Home Purchase or Mortgage Refinance

August 19, 2025

Did You Know? Did you know that Canada's latest inflation figure has cooled to 1.7% according to Statistics Canada? For everyday Canadians, this is more than a headline. It can point to lower bor ...

read moreIs the Mortgage Stress Test on the Way Out?

August 7, 2025

Is the Mortgage Stress Test on the Way Out? How OSFI's New Loan-to-Income Rules Could Reshape Borrowing in 2025-26 Canadian borrowers have spent the past seven years living with the mortgage "s ...

read moreBank of Canada holds policy rate at 2.75%

July 30, 2025

The Bank of Canada today maintained its target for the overnight rate at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%. While some elements of US trade policy have started to become m ...

read moreMortgage Payments Ease, Renewal Stress Grows in Canada

July 16, 2025

Mortgage Payments Are Easing Yet Renewal Stress Is Real It feels like a collective exhale. After two grueling years of rapid interest‑rate hikes, the Bank of Canada has paused an ...

read more